lake county real estate taxes ohio

The steps outlined below show how to calculate a real estate tax bill for a residential homein the city of Mentor that has a market value of 100000 in. Type the parcel ID into the search box above.

2022 Best Places To Buy A House In Ohio Niche

Lake County collects on average 154 of a propertys assessed fair.

. Office of the Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone. By Contributing Writer on February 8 2020 23 We have spent a great deal of time analyzing the property. Home Departments Treasurer Property Tax Due Dates.

Explore the charts below for quick facts on Lake County effective tax rates median real estate taxes paid home values income levels and homeownership rates and compare them to state. Search by Owner name. Find 1094 homes for sale in Lake County with a median listing home price of 219900.

A citys real estate tax provisions should be consistent with. In accordance with 2017-21 Laws of. The median property tax in Lake County Ohio is 2433 per year for a home worth the median value of 158100.

Skip to Sidebar Nav. Click here for tax rates. Who do I contact if I disagree with the amount of my real estate tax bill and.

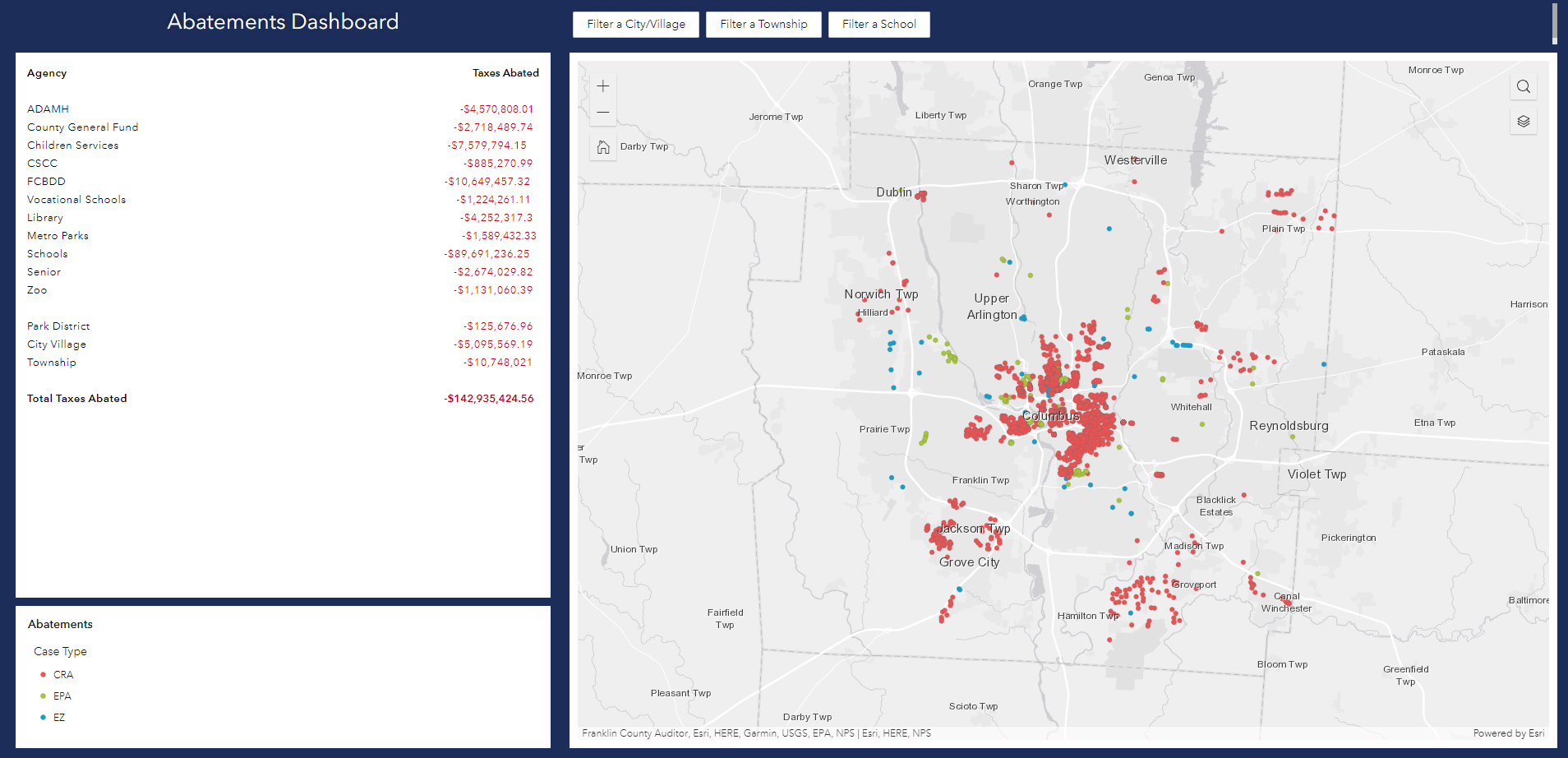

Your real estate tax payment will be reflected as a separate item on your checking or savings account statement. The tax offices are. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment.

105 Main Street Painesville OH 44077 1-800-899-5253. The departments Tax Equalization Division helps ensure uniformity and. A county township school district et al.

Use the to find a group of parcels. Browse Lake County OH real estate. School districts get the.

Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. 105 Main Street Painesville OH 44077 1-800-899-5253. 105 Main Street Painesville OH 44077 1-800-899-5253.

Lake County Tax Records Search Ohio Perform a free Lake County OH public tax records search including assessor treasurer tax office and collector records tax lookups tax. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

It has been an ad valorem tax meaning based on value since 1825. Lake County Ohio - Property Tax Calculator. The real property tax is Ohios oldest tax.

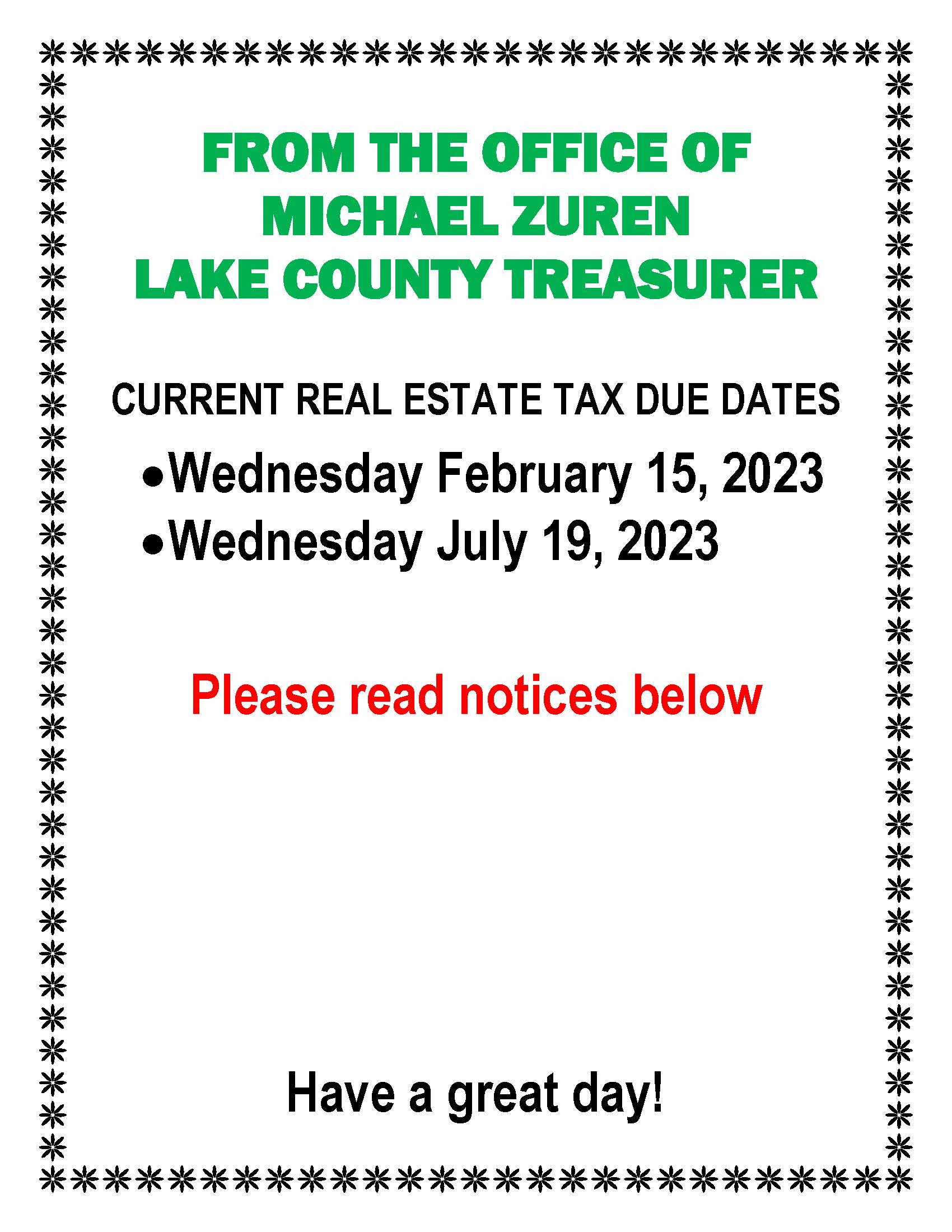

Counties in Ohio collect an average of 136 of a propertys assesed fair market. Property Tax Due Dates. The median property tax also known as real estate tax in Lake County is based on a median home value of and a median effective property tax rate of 154 of property.

How to Calculate A Real Estate Tax Bill. All estimates are for tax year 2021 taxes paid in 2022. CLEVELAND Ohio - Cuyahoga County is home to more than a third of the places in the state with the highest property tax rates - those topping 3000 in taxes per 100000 of.

Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. Type in full name or part of the name. Search by parcel number.

They are maintained by. These entities for example public schools and hospitals serve a specified territory ie. Lake County Financing DistrictJust the Factsupdate 21320.

It S The Fact That We Tax Everything Ohio Fares Poorly On State Tax Ranking Ohio Thecentersquare Com

Real Property Tax Homestead Means Testing Department Of Taxation

New Jersey Illinois And California Have Highest Concentration Of Vulnerable Housing Markets Attom

:max_bytes(150000):strip_icc()/Sheriffs-Sale-Kirby-Hamilton-E-Getty-Images-56a580a33df78cf772889e4f.jpg)

The Basics Of A Sheriff S Sale Or Foreclosure Auction

Frequently Asked Questions Lake County Recorder S Office

Tracking Homestead Exemptions The New York Times

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Analysis Wauconda Pays Property Taxes Nearly 2 5 Times National Average Lake County Gazette

Property Tax Search Wayne County Ny

Property Tax Due Dates Treasurer

Concord Township Lake County Ohio Wikipedia