inherited annuity taxation irs

Read About the Main Types. The reason is that these annuities have already been subject to income tax.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The earnings are taxable over the life of the payments.

. Februarys amended guidance to inherited individual retirement accounts IRAs by the Internal Revenue Service has holders and tax-paying beneficiaries looking for guidance on. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More.

Either way you will pay regular taxes only on the interest. The basis of property inherited from a decedent is. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

These annuities have already been subject to income tax however any. In many cases the IRS requires the first payment from an inherited IRA to be made by December 31 of the calendar year following the owners death. Unfortunately gains are distributed.

In turn taxation of annuity distributions. Treat it as his or her own IRA by designating. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals.

Peyton Fulford for The Wall Street Journal. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. Ad Get this must-read guide if you are considering investing in annuities.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Annuities are often complex retirement investment products. Understanding the Different Types of Annuities Can be Confusing.

An insurance annuity is a contract between an insurance company and an individual that provides for periodic payments beginning either immediately or at some future. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. How taxes are paid on an.

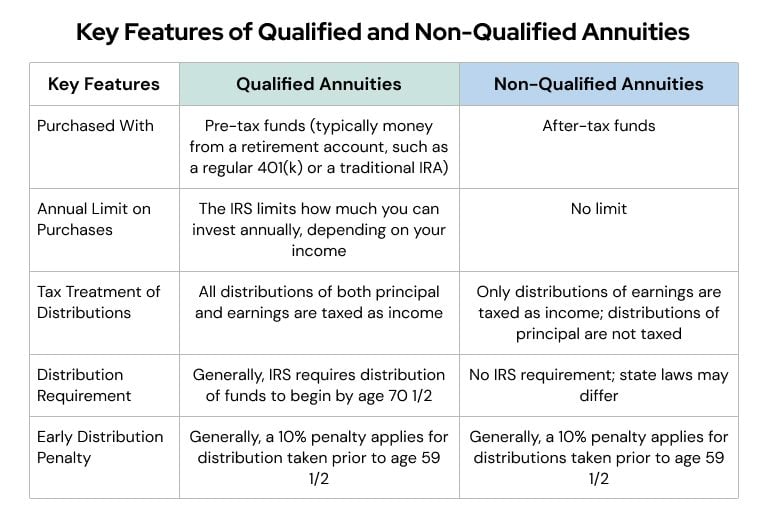

However any interest thats been earned will be taxed once withdrawn. If a traditional IRA is inherited from a spouse the surviving spouse generally has the following three choices. A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars.

An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. These payments are not tax-free however. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

Read About the Main Types. To determine if the sale of inherited property is taxable you must first determine your basis in the property. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Inherited from spouse.

Margaret Rolo of Rancho Mirage Calif hasnt touched her 400000 inherited IRA from her mother who died in 2020. Any beneficiary including spouses can choose to take a one-time lump sum payout. If you inherit this type.

In this case taxes are owed on the entire difference between what the original owner. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed.

Understanding the Different Types of Annuities Can be Confusing. But even a series of five equal distributions has tax drawbacks. An annuity normally includes both gains and non-taxable principal.

Learn some startling facts.

3 11 3 Individual Income Tax Returns Internal Revenue Service

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

3 11 3 Individual Income Tax Returns Internal Revenue Service

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

We Solve Tax Problems Debt Relief Programs Tax Debt Payroll Taxes

Form 5329 Instructions Exception Information For Irs Form 5329

Annuity Exclusion Ratio What It Is And How It Works

3 11 3 Individual Income Tax Returns Internal Revenue Service

W 9 Form What Is It And How Do You Fill It Out Smartasset Fillable Forms Tax Forms Blank Form

Annuity Taxation How Various Annuities Are Taxed

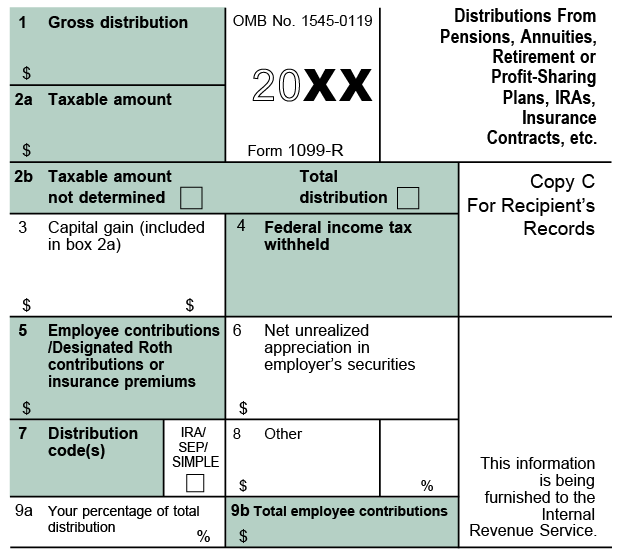

Irs Form 1099 R Box 7 Distribution Codes Ascensus

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Qualified Vs Non Qualified Annuities Taxation And Distribution