kentucky property tax calculator

25000 income Single with no children - tax 1136. Kentucky does not charge any additional local or use tax.

Kentucky Property Taxes By County 2022

Different local officials are also involved and the proper office to contact in each stage of the property tax cycle will be identified.

. If you dont know your assessment value or tax district please look it up here using your address. A convenience fee of 249 for payments over 6000 or a flat fee of 150 for payments under 6000 charged by a third party vendor will be added to all credit transactions. The state of Kentucky has a flat sales tax of 6 on car sales.

The Rowan County Sheriffs Department is now accepting Visa MasterCard American Express Discover credit cards for tax payments. The highest property tax rate in the state is in Campbell County at 118 whereas the lowest property tax rate in Kentucky is 056 in Carter County. The median property tax on a 14520000 house is 149556 in Kenton County.

Kentucky Income Tax Calculator 2021. The median property tax on a 14520000 house is 152460 in the United States. State law - KRS 132020 2 - requires the State real property tax rate to be reduced anytime the statewide total of real property assessments exceeds the previous years assessment totals by more than 4.

Ad AARPs Calculator is Designed to Examine the Potential Return From an Investment Property. The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Kentucky State Income Tax Rates and Thresholds in 2022. Use this free Kentucky Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

Property not exempted has to be taxed equally and consistently at present-day values. Details of the personal income tax rates used in the 2022 Kentucky State Calculator are published below the. Calculate Understand Your Potential Returns.

Maximum Possible Sales Tax. Kentucky Property Tax Calculator - SmartAsset 2022 Table of Contents. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate.

For example the sale of a 200000 home would require a 200 transfer tax to be paid. State Real Property Tax Rate. Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected.

Additionally you will find links to contact information. 35000 income Single parent with one child - tax 1676. Please note that this is an estimated amount.

Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. For Kentucky it will always be at 6.

Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. 50000 income Married with one child - tax 2526. Select an Income Estimate.

The median property tax on a 14520000 house is 104544 in Kentucky. Oldham County collects the highest property tax in Kentucky levying an average of 224400 096 of median home value yearly in property taxes while Wolfe County has the lowest property tax in the state collecting an average tax of 29300 054. The city establishes tax levies all within the states statutory directives.

There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. Of course where you choose to live in Kentucky has an impact on your taxes. Actual amounts are subject to change based on tax rate changes.

Find All The Record Information You Need Here. Property Can Be an Excellent Investment. 60000 income Single parent with one child - tax 3126.

Various sections will be devoted to major topics such as. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. All rates are per 100.

Your Search for Real Updated Property Records Just Got Easier. Looking for managed Payroll and benefits for your business. This calculator will determine your tax amount by selecting the tax district and amount.

All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property. A citys real estate tax regulations should comply with Kentucky constitutional rules and regulations. For comparison the median home value in Kentucky is 11780000.

The Kentucky Department of Revenue is required by the Commonwealth Constitution Section 172 to assess property tax at its fair cash value estimated at the price it would bring at a fair. Yes I have. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Ad Unsure Of The Value Of Your Property. 80000 income Married with two children - tax 3251.

When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. The annual tax assessed by a. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

If you are receiving the homestead exemption your assessment will be reduced by 40500. Campbell County has the highest average effective rate in the state at 117 while Carter County has the lowest rate at a mere 051. How to Calculate Kentucky Sales Tax on a Car.

The tax estimator above only includes a single 75 service fee. Average Local State Sales Tax. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

The assessment of property setting property tax rates and the billing and collection process. Get a free quote. As always The Rowan.

Owners rights to timely notice of tax levy hikes are also obligatory. The exact property tax levied depends on the county in Kentucky the property is located in. This calculator uses 2021 tax rates.

Just Enter an Address.

Property Tax How To Calculate Local Considerations

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Kentucky Sales Tax Small Business Guide Truic

Income Tax Calculator 2021 2022 Estimate Return Refund

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

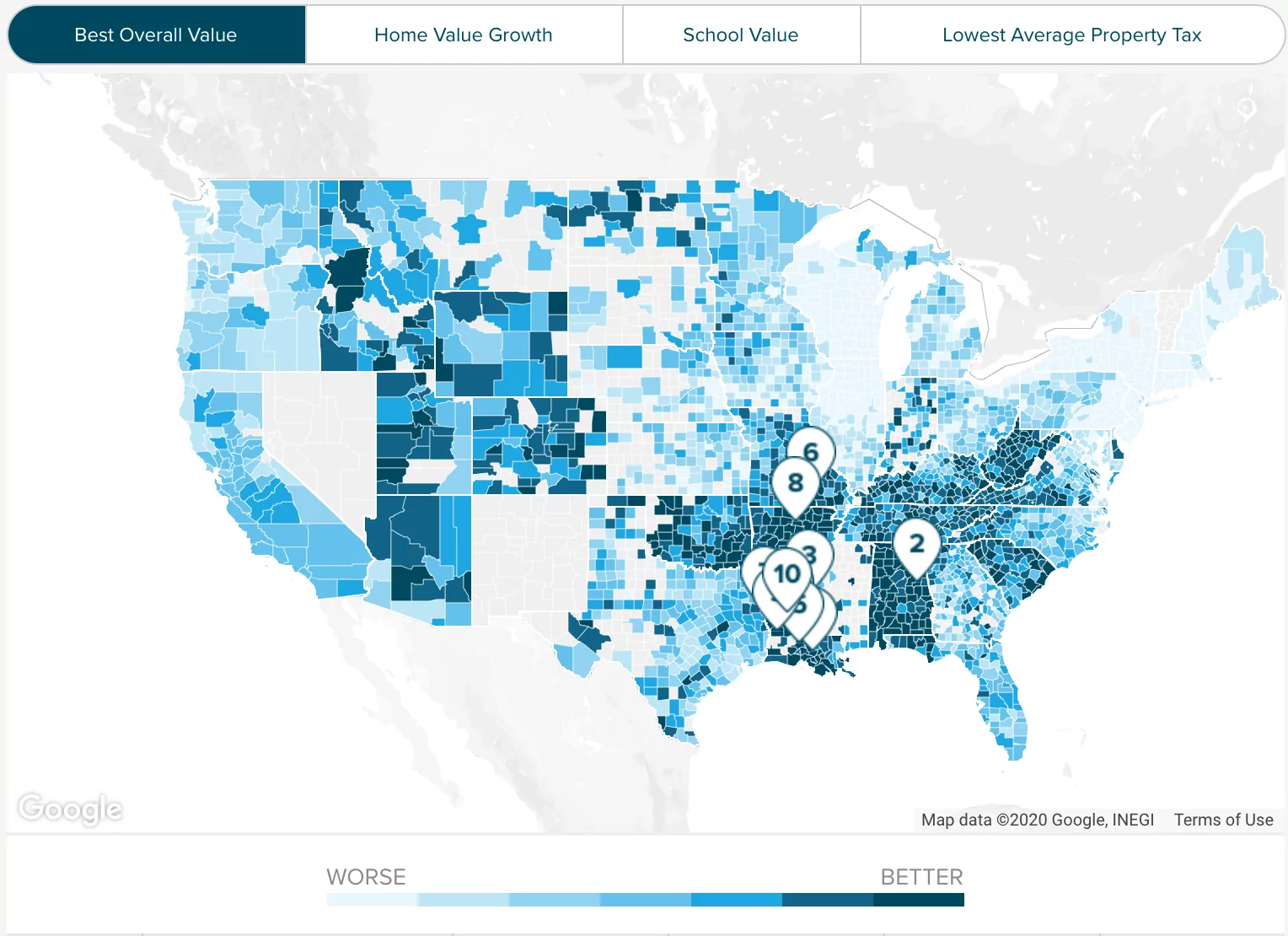

Where People Pay Lowest Highest Property Taxes Lendingtree

How To File The Inventory Tax Credit Department Of Revenue

Kentucky League Of Cities Infocentral

Jefferson County Ky Property Tax Calculator Smartasset

Property Tax Calculator Casaplorer

Property Taxes Property Tax Analysis Tax Foundation

North Central Illinois Economic Development Corporation Property Taxes

Kentucky Property Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation